Steering through the complexities of universal life insurance can be intimidating. With various policy types and features, it’s easy to feel overwhelmed. However, software technology is changing the landscape, offering intuitive tools that simplify comparisons and enhance understanding. By leveraging these resources, you can make more informed decisions about your insurance options. But what specific technologies are making the biggest impact, and how do they transform your experience with universal life insurance?

Key Takeaways

- User-friendly comparison tools allow users to easily assess different universal life insurance policies based on their preferences and needs.

- Online calculators simplify complex calculations, helping individuals understand premium costs and potential cash value growth.

- Interactive tutorials provide clear explanations of intricate terms and concepts related to universal life insurance.

- Personalized dashboards enable policyholders to track performance and receive tailored insights on their insurance policies.

- AI-driven analytics offer customized policy recommendations, making the selection process more efficient and aligned with individual financial goals.

The Complexity of Universal Life Insurance Policies

While you may seek flexibility and long-term benefits, the complexity of universal life insurance policies can be intimidating. These policies offer various types, each designed to meet different financial goals and needs. You might encounter traditional universal life, variable universal life, and indexed universal life, each differing in how premiums, cash value, and investment options function. Understanding these types of universal life insurance policies is essential, as their features can greatly impact your financial planning. Grasping the intricacies of these options helps guarantee you’re making informed decisions that align with your objectives. By breaking down the complexities, you can navigate through the choices with confidence and find a policy that truly fits your lifestyle and aspirations.

Key Types of Universal Life Insurance Policies Explained

When exploring the key types of universal life insurance policies, you’ll find distinct options tailored to various financial goals. The first type is the flexible premium universal life insurance, which allows you to adjust your premium payments and death benefit as your needs change. Then, there’s indexed universal life insurance, linking your cash value growth to a stock market index, offering potential for higher returns with some downside protection. Finally, you might consider guaranteed universal life insurance, focusing primarily on providing a death benefit with minimal cash value accumulation. Each type serves different purposes, so it’s important to assess your personal financial situation and long-term objectives before choosing the right policy for you.

How Software Technology Simplifies Policy Comparison

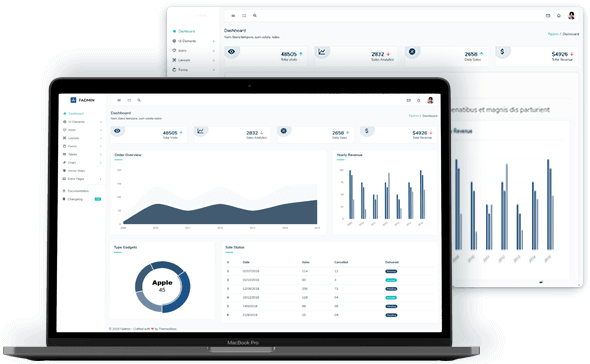

How can software technology enhance your understanding of different universal life insurance policies? By providing user-friendly comparison tools, software technology simplifies the process of evaluating various policy options. You can easily input your preferences and receive tailored comparisons, highlighting key features, benefits, and costs associated with different types of universal life insurance policies. This not only saves you time but also guarantees you make informed decisions based on your unique needs. Additionally, visual aids like graphs and charts allow you to quickly grasp complex information, making the comparison process less overwhelming. With these tools at your disposal, you can feel more confident maneuvering the complexities of universal life insurance, fostering a sense of belonging in your financial journey.

Enhancing Customer Understanding Through Digital Tools

Digital tools are reshaping the way customers understand universal life insurance policies by making complex information more accessible. With user-friendly interfaces, online calculators, and interactive tutorials, you can easily explore the different types of universal life insurance policies. These digital resources break down intricate terms and concepts, allowing you to grasp essential details without feeling overwhelmed. Additionally, personalized dashboards can track your policy performance and provide tailored insights, enhancing your engagement with the product. By leveraging these tools, you’re not just a policyholder; you’re an informed participant in your financial planning. Embracing technology helps foster a sense of community among policyholders, as you share insights and experiences with others traversing the same journey.

The Future of Universal Life Insurance With Technology Integration

As technology continues to evolve, the future of universal life insurance is poised for significant transformation. You’ll see innovations like AI-driven analytics that personalize policy options, making it easier for you to choose the right plan. Real-time data integration can enhance your understanding of the various types of universal life insurance policies, ensuring you’re well-informed and confident in your decisions. Mobile apps may streamline communication with insurers, allowing you to manage your policy effortlessly. Additionally, blockchain technology could increase transparency and security, fostering trust in the process. Ultimately, these advancements not only simplify your experience but also create a sense of belonging within a community of informed policyholders. Embracing this future means you’re not just a customer; you’re an empowered participant.

Conclusion

To sum up, embracing software technology revolutionizes how you approach universal life insurance. By utilizing comparison tools and interactive resources, you can effortlessly navigate complex policies, ensuring you make informed decisions. Visual aids and personalized dashboards enhance your understanding and track performance over time. As technology continues to evolve, you can expect even greater integration and support in managing your insurance needs, ultimately leading to a more confident and streamlined experience in securing your financial future.

You May Also Like To Read: